How is Lendica different?

Traditional lenders rely on generic summary statistics and legacy credit scores.

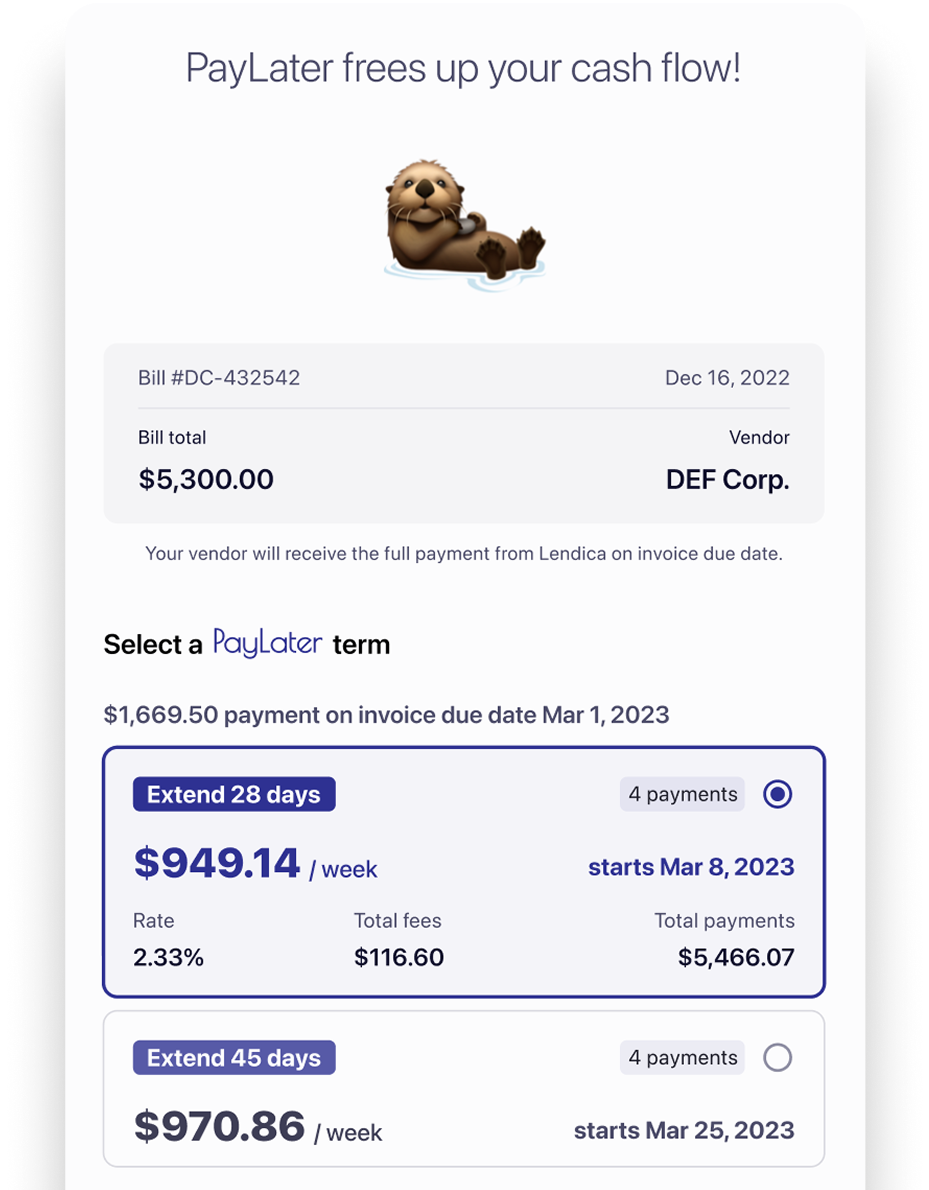

Lendica (with its AI-powered underwriting engine) delivers fast and affordable loan offers by diving deep into real-time business operations data.

Our customers also praise our simple and quick application process!